-

Insights - Thu, Feb 13th, 2025

-

TR 2013/2 – Income tax: school or college building funds

The Australian Taxation Office (ATO) published an updated consolidated version of Taxation Rulian TR 2023/2 regarding school building funds (SBFs). Here's what is means: Read more

Insights - Tue, Oct 15th, 2024 -

Full Federal Court’s PBI judgment on Equality Australia Ltd v Commissioner of the Australian Charities and Not-for-profits Commission

Equality Australia Limited was unsuccessful in its registration dispute for public benevolent institution status with the ACNC. Its advocacy work for law reform and social change lacked a ‘sufficient connection’ to the relief of the distress of LGBTQI+ people. The Federal Court of Australia found that there was no error of law and dismissed the appeal.

Insights - Mon, Sep 9th, 2024 -

Productivity Commission – Future foundations for giving – Draft report

On 30 November 2023, the Productivity Commission released its draft report into Future foundations for giving (Draft Report).

The purpose of the Draft Report is to establish foundations for the future of philanthropy in Australia.Insights - Thu, Dec 14th, 2023 -

Insights - Mon, Oct 23rd, 2023

-

Related party transactions

What is a Related Party Transaction?

A related party transaction is a transfer of resources, services or obligations between a charity and a related party. Examples of such transfers include:

• Sales or purchases of goods, other property or services

• Leases

• Loans.

The transfer does not have to involve a financial payment.News - Wed, Aug 23rd, 2023 -

Updated transparency requirements under the Commonwealth Electoral Act

With a federal election looming, the ACNC has recently confirmed that a charity may advocate on political matters consistent with its charitable purpose, provided it does not advocate for a particular party of candidate. In short, issue-based advocacy is fine, but partisan advocacy is not.

News - Fri, Mar 11th, 2022 -

News - Thu, Mar 10th, 2022

-

News - Wed, Mar 9th, 2022

-

Prolegis Lawyers ranked Band 1 by Chambers

In the 2022 awards for Australian law firms in the practice area of Charities, Prolegis Lawyers was again ranked by Chambers in the highest Band, Band 1 in the Australian Charities section alongside three much larger full-service firms..

News - Mon, Jan 17th, 2022 -

Recent changes to the Corporations Act for electronic meetings, notices, minute books and e-signing due to the Covid-19 pandemic

The Commonwealth Parliament has introduced new temporary changes to the Corporations Act 2001 (Cth) that will assist companies during the Covid-19 pandemic to conduct meetings of directors and members electronically and execute documents electronically.

News - Tue, Nov 16th, 2021 -

Recent decisions in Australian charity law – update

The Administrative Appeals Tribunal and Federal Court of Australia have recently handed down a set of decisions that have major implications for the Australian charity law sector and for charities and not-for-profit organisations across Australia.

News - Tue, Nov 16th, 2021 -

New requirements for DGRs to be registered as charities with the ACNC

Entities endorsed as Deductible Gift Recipients (DGRs) that are not currently registered as charities with the Australian Charities and Not-for-profits Commission (ACNC) will soon be required to be registered as charities with the ACNC.

News - Fri, Sep 10th, 2021 -

High Court rules on who is a Casual employee

On 4 August 2021 the High Court of Australia issued a decision in Workpac P/L v Rossato (2021) HCA 23 (Decision) on casual employment.

Article - Thu, Aug 12th, 2021 -

Streamlining of regulation of charities undertaking fundraising in NSW

Charities that undertake charitable fundraising in NSW will welcome the regulatory reforms, effective from 1 July 2021, that have introduced a streamlined application process to apply for, and renew, an authority to fundraise in NSW. Simplified reporting requirements for ACNC-registered charities have also been introduced as part of the reform package that will benefit charities undertaking fundraising in NSW.

News - Mon, Jul 19th, 2021 -

Changes to Charities’ Financial Reporting Obligations

On 30 June 2021, the Federal Government announced changes to financial reporting obligations in the next financial year: https://ministers.treasury.gov.au/ministers/michael-sukkar-2019/media-releases/cutting-red-tape-charities

News - Mon, Jul 19th, 2021 -

Changes to Casual Employment

The Fair Work Act 2009 (Cth) (FWA) was recently changed by the Commonwealth Parliament and those changes will impact on casual employment.

News - Mon, Apr 19th, 2021 -

Women’s Life Centre – A recent decision of the Administrative Appeals Tribunal regarding Public Benevolent Institutions (PBIs)

The Administrative Appeals Tribunal (AAT) issued its decision in Women’s Life Centre Inc v Commissioner of the Australian Charities and Not-for-profits Commission [2021] AATA 500 on 12 March 2021.

-

Final Report of the 2020 Review of Disability Standards for Education 2005

In 2020, the Commonwealth Department of Education, Skills and Employment (the Department) conducted a review of the Disability Standards for Education 2005 (Cth) (the Standards) made pursuant to the Disability Discrimination Act 1992 (Cth) (the DDA).

News - Tue, Mar 16th, 2021 -

Royal Commission into Aged Care Quality and Safety - final report released

The Royal Commission into Aged Care Quality and Safety released its Final Report on 1 March 2021. The Final Report was released following an extensive public hearing schedule and research programme.

News - Fri, Mar 5th, 2021 -

UPDATE 25 February 2021: Introducing ACNC Governance Standard 6 and changes to Basic Religious Charity eligibility

Today, the Australian Charities and Not-for-profits Commission (ACNC) announced the introduction of a new governance standard: Governance Standard 6 – Maintaining and enhancing public trust and confidence in the Australian not-for-profit sector (Governance Standard 6).

Insights - Thu, Feb 25th, 2021 -

Treasury Consultation: Proposed changes to ACNC Governance Standard 3

Treasury is seeking submissions regarding a proposal to broaden ACNC Governance Standard 3.

News - Fri, Feb 19th, 2021 -

Breaking: Charities to lose charitable status if they fail to join the National Redress Scheme

Today the Commonwealth Government has announced that it will pass new laws to empower the Australian Charities and Not-for-profits Commission (ACNC) to deregister a charity that has not taken steps to participate in the National Redress Scheme for Institutional Child Sexual Abuse (National Redress Scheme) in circumstances where it has been named, or is likely to be named, in an application to the National Redress Scheme.

News - Fri, Nov 27th, 2020 -

New Bill – Requiring DGRs to Register as Charities

Treasury has recently published an Exposure Draft of its proposals to reform the Income Tax Assessment Act 1997 (Cth) to require non-Government Item 1 Deductible Gift Recipients (DGR) to register as charities. These reforms are part of the Commonwealth Government’s recent initiatives to reform and simplify DGRs, as proposed in its 2017-2018 Mid-Year Economic and Fiscal Outlook.

Insights - Tue, Oct 13th, 2020 -

Federal Budget 2020-21

We have listed the measures in the Federal Budget 2020-21 delivered by the Treasurer on 6 October 2020 that are relevant to charities, not-for-profits and philanthropic organisations.

Insights - Thu, Oct 8th, 2020 -

NZ High Court finds Greenpeace NZ should be registered as a charity

Charity laws in Australia and New Zealand have lots of similarities and also some key differences. The long-running saga of the application by Greenpeace of New Zealand Inc (Greenpeace NZ) for charitable status in New Zealand is a good illustration of this.

Insights - Wed, Aug 26th, 2020 -

A member of a charity has a fiduciary duty to act in the best interest of the charity?

On 29 July 2020, the Supreme Court of the United Kingdom handed down its judgment in Lehtimäki and others v Cooper [2020] UKSC 33, which confirmed that members of charitable companies in the United Kingdom are fiduciaries and must therefore make decisions and act in the companies’ best interests (that is, to serve the purposes of the charities) to the exclusion of their own or any other party’s interests.

Insights - Fri, Jul 31st, 2020 -

Key Changes- incorporated associations in Queensland

On 22 June 2020, the Associations Incorporation and Other Legislation Amendment Act 2020 (Queensland) (Amendment Act) was assented to.

News - Thu, Jul 2nd, 2020 -

Bill for new DGR category for Community Sheds now law

A Bill to implement a new Deductible Gift Recipient (DGR) category for Community Sheds has recently been introduced by the Australian Government. This new category implements the Australian Government’s announcement in its 2019-20 Budget that a new DGR general category would be created to enable Men’s Sheds and Women’s Sheds to access the DGR endorsement.

News - Wed, Sep 16th, 2020 -

UPDATE 2 June 2020: SME Commercial Leasing Principles During COVID-19 - what does it mean for charities and not-for-profits?

In response to the COVID-19 crisis, the Federal Government has announced measures relating to rental arrangements between landlords and tenants (residential, retail and commercial tenancies).

News - Tue, Jun 2nd, 2020 -

Draft bill for new DGR Category: Men’s and Women’s Sheds

UPDATE: The government has recently announced that due to the COVID-19 pandemic, introduction of legislation to enact this proposed DGR category will be deferred indefinitely. Please contact Jae Yang (Partner) if you have any questions.

In its 2019-20 Budget, the Federal Government announced it will establish a DGR general category to enable Men’s Sheds and Women’s Sheds (Sheds) to access DGR status from 1 July 2020.News - Wed, Apr 15th, 2020 -

ACNC to review registered charities beginning with Public Benevolent Institutions in July 2020

The Australian Charities and Not for Profits Commission (ACNC) will review 500 Public Benevolent Institutions (PBIs) over the year from July 2020 as a start to its review of a selection of registered charities which are deductible gift recipients (DGRs). Such charities should prepare for the review.

News - Tue, Mar 17th, 2020 -

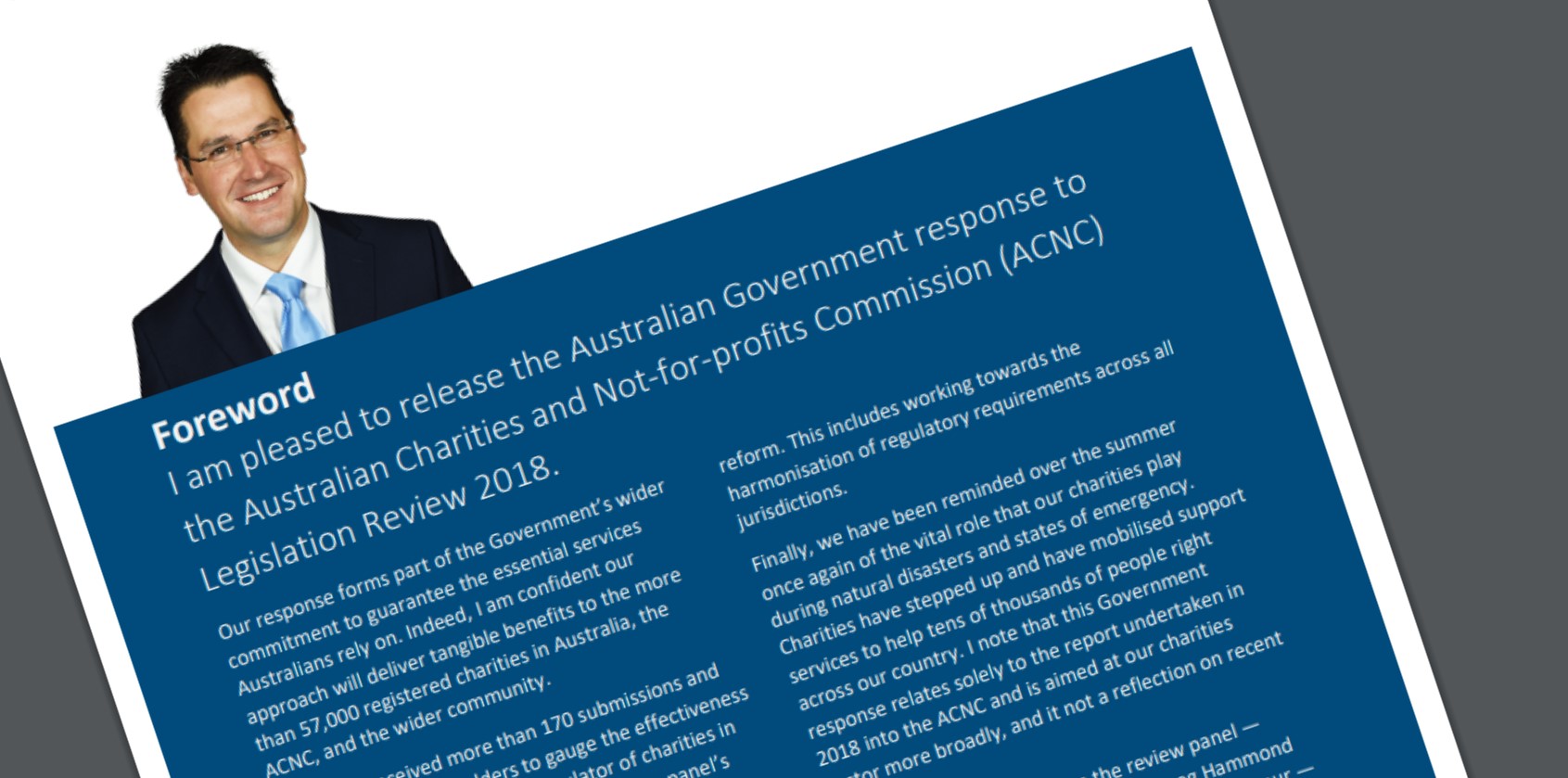

Government response to the recommendations of the ACNC Legislation Review

The Federal Government today released its response to the recommendations of the ACNC Legislation Review (Government Response to the Australian Charities and Not-For-Profits Commission Legislation Review 2018, 6 March 2020). The report of the review panel had been tabled in Parliament in August 2018.

News - Fri, Mar 6th, 2020 -

Fundraising– considerations for charities, fundraisers and donors

The extensive devastation of the bushfires has compelled many people to make donations and fundraise to assist affected communities, support fire services, and care for injured wildlife, etc.

Insights - Wed, Feb 19th, 2020 -

Minute-taking post Banking Royal Commission

The Financial Services (Banking) Royal Commission, among many other aspects of good corporate governance, put the practice of minute-taking under a spotlight and, in particular, how detailed should board minutes be.

Insights - Thu, Feb 6th, 2020 -

Taxation Ruling: 'in Australia' conditions

On 18 December 2019, the Australian Taxation Office has released its Ruling TR 2019/6, which sets out the Commissioner’s position on the ‘in Australia’ conditions for certain deductible gift recipients and income tax exempt entities. TR 2019/6 finalises the Commissioner’s view expressed in draft Taxation Ruling TR 2018/D1.

News - Fri, Dec 20th, 2019 -

Key changes to the Victorian Fundraising Act

The Victorian Parliament has passed the Consumer Legislation Amendment Act 2019 (Vic) which will significantly amend the Fundraising Act 1998 (Vic). The amendments will come into force on 31 August 2020 or an earlier date by proclamation.

News - Fri, Dec 13th, 2019 -

New protections for whistleblowers – what does it mean for charities and not-for-profits? UPDATE

A new whistleblower protection regime, which will apply to all companies from 1 July 2019, received royal assent on 12 March 2019. An immediate focus for many charities and not-for-profits will be the new requirement that any structured as public companies (including companies limited by guarantee) and large proprietary companies must have a whistleblower policy from 1 January 2020.

News - Thu, Nov 14th, 2019 -

Significant Changes in Payment and Record Keeping Requirements for Clerical and Administrative Staff

On 4 July 2019 a Full Bench of the Fair Work Commission (FWC) finalised arrangements related to their earlier decision that flagged significant changes to the annualised salary provisions for employees who are covered by the Clerks Private Sector Award (and some other awards). These changes, which will take effect from 1 March 2020, are described below.

Article - Mon, Jul 29th, 2019 -

New Tax Office Ruling - Fringe Benefits Provided to Religious Practitioners

On 19 June 2019, the Australian Taxation Office released its Ruling TR 2019/3 which sets out the Commissioner’s position on when a benefit provided by registered religious institutions to religious practitioners will be exempt from fringe benefits tax (FBT). TR 2019/3 finalises the Commissioner’s view expressed in draft Taxation Ruling TR 2018/D2 and replaces the now withdrawn Taxation Ruling TR 92/17W.

News - Fri, Jun 21st, 2019 -

ACNC External Conduct Standards - Update

In November 2018, Regulations under the Australian Charities and Not-for-profits Commission Act 2012 (Cth) were tabled in Parliament to introduce new ‘external conduct’ standards for registered charities operating directly or indirectly overseas.

This article examines when the new standards will most likely take effect, in the context of the Federal election that has been called this week.News - Fri, Apr 12th, 2019 -

Fair Work Australia decision will introduce changes in entitlements and record keeping requirements of clerical and administrative employees

On 27 February 2019 the Fair Work Commission (FWC) decided to significantly change the annualised salary provisions for employees covered by the Clerks Private Sector Award. The exact date that the changes will take effect are not yet known, but is expected to be announced in the next few months.

News - Thu, Mar 28th, 2019 -

Royal Commission into Violence, Abuse, Neglect and Exploitation of People with Disability

In recent days, the Australian Parliament has agreed to establish a Royal Commission into the abuse of persons with disabilities.

News - Wed, Mar 6th, 2019 -

National Redress Scheme Update

The National Redress Scheme provides an opportunity for eligible survivors of institutional child sexual abuse to apply for redress where the responsible institution has joined the Scheme. The Scheme was introduced in response to the Royal Commission into Institutional Responses to Child Sexual Abuse.

News - Mon, Mar 4th, 2019 -

DGR reform proposals

The Commonwealth Treasury has outlined details of proposed changes to the rules for Deductible Gift Recipients (DGRs) in a Consultation Paper released on 22 August 2018. If enacted in law, DGRs which are not already registered as charities will need to take action, and those with multiple public funds may be able to streamline their arrangements.

The future of these reforms is uncertain following the changes to the federal government’s ministry last week. Kelly O’Dwyer, the former Minister for Revenue and Financial Services was sponsoring the changes. At the time of writing it is not yet clear which Minister will now have responsibility for these reforms.

Submissions regarding the proposed changes can be made to Treasury, by the closing date of 17 September 2018.News - Thu, Aug 30th, 2018 -

Release of the ACNC Review Report

The much anticipated report of the ACNC Review Panel, entitled “Strengthening for Purpose – Australian Charities and Not-for-profits Commission Legislation Review 2018”, was tabled in Parliament and published on 22 August 2018. This article highlights the key conclusions and reform proposal included in the Review Panel's report.

News - Thu, Aug 23rd, 2018 -

Not So Casual

Last week a Full Court of the Federal Court of Australia held that a truck driver employed by a labour hire company to work at a Queensland coal mine was entitled to paid annual leave despite the fact he had an employment letter stating he was engaged as a casual employee. This article looks to put this ruling in broader perspective and highlights matters that any organisation which employs casuals should consider as a consequence of last week's Federal court ruling.

News - Wed, Aug 22nd, 2018